France will transfer part of the VAT to the regions

The French Governement and the Association of French Regions agree to replace the state subsidy by a fraction of the income generated by VAT

The French Prime Minister, Manuel Valls, announced that a portion of the VAT will be transferred to the Regional Councils as of January 2018. The decision was made following the negotiations between the Government and the Association of French Regions (ARF), chaired by Philippe Richert, which resulted in the agreement to replace the Overall Functioning Allocation “Dotation Globale de Fonctionnement (DGF)” that the State pays the regions by a fraction of the income generated by VAT.

This annual allocation by the State consisted of 3.8 million euros, while a one-percentage point of VAT would represent between 7 and 8 million euros. This measure aims at solving the problem of how to fund the “Local Economic Development”, which was the domain of departments until the Territorial Reform transferred it to the regions without the corresponding funds. The French regions had a great need of this revenues to be able to adequately assume the new economic responsibilities and support the growth of social expenditure in their territories.

More powers

The regional authorities have welcomed the new measure as a step towards a “real decentralization” that will allow to set out the responsibilities of the territorial actors and reduce the dependency on the state grants. Even if the VAT transfer shall be applied from 2018, the 2017 budget will include a transitional facility and an action fund with a limit of 450 million euros –150 less than what the ARF was claiming– to keep up the economic actions of the regions.

Related content:

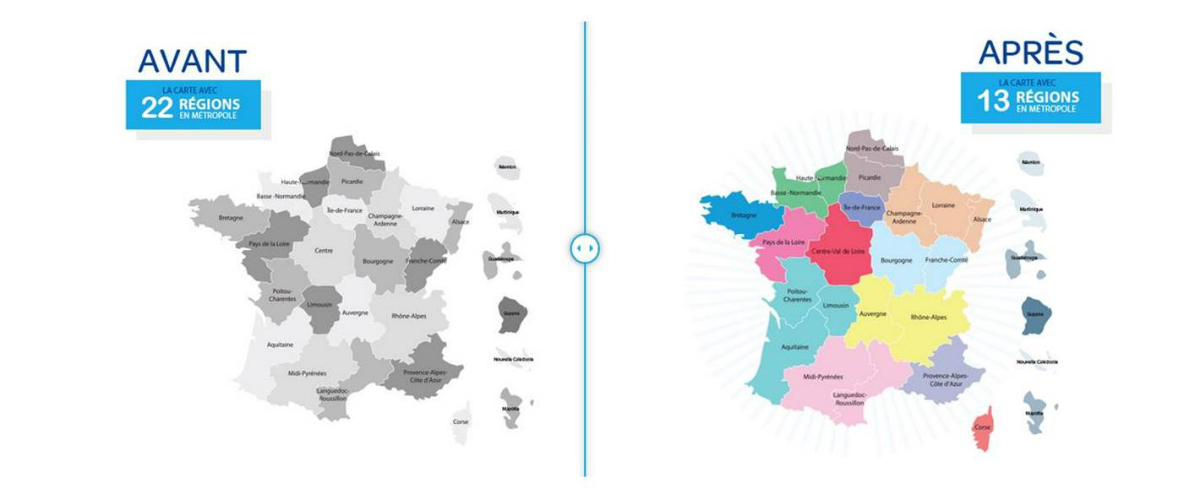

France approves a territorial reform. Article published by ORU Fogar, 17/09/2016

Philippe Richert, ARF's new President. Article published by ORU Fogar 08/08/2016