R20: Streamlining sub-national infrastructure investments in the green economy

Dr. Christophe Nuttall,

Executive Director, R20 – Regions of Climate Action

Subnational authorities have gained, this last decade, high recognition to lead climate change actions, and with the global consensus on the need to confine global temperature rises “well below 2°C” reflected in the Paris Agreement and the adoption of the United Nations 2030 Agenda for Sustainable Development and the Sustainable Development Goals, the political support for low carbon and climate resilient infrastructure projects has never been stronger. In addition, the availability and rapidly declining costs of clean technologies - e.g. solar energy costs have decreased at a rate of 10% per year over the past 30 years - and the growing appetite amongst some of the largest investors on the planet – Sovereign Funds, insurance companies and pension funds – to significantly increase their capital allocations to renewable energy infrastructure provides a great opportunity to accelerate the transition to a sustainable, low-carbon economy. And yet, the ideal pipeline of green infrastructure projects is still not happening. Investors are still failing to put money into such green solutions and few projects are being implemented. As mentioned by Christiana Figueres, former Executive Secretary of the UNFCCC, institutional investors – pension funds, insurance companies, foundations and investment managers – are committing less than 2% of their funds to clean energy infrastructure, compared to 10%-15% to coal and oil.

Amongst the most significant reasons for this mismatch between demand and implementation is the lack of bankable projects reaching investors. If a project does not satisfy the investor regarding its management of risk, and the provision of what it judges to be commensurate investment return, the money will simply go elsewhere. For R20, this problem is associated with the limited degree of collaboration, understanding and interconnection of the different players in the “value chain” of project development and financing. Almost invariably, key players do not understand what makes a project “bankable”, they do not understand each other’s interests nor how their decisions can impact negatively on each other, and therefore on the bankability of projects.

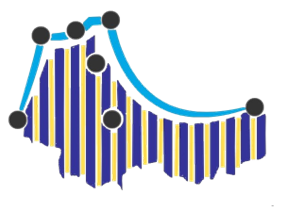

To address this “market failure”, R20 has developed an operational financial and technical ecosystem – the R20 value chain – able to balance the needs of investors and other stakeholders throughout the whole process of green infrastructure project development, financing and implementation.

Projects Identification: R20 works with networks of sub-national authorities, among which ORU-Fogar, AER, ICLEI, SALGA and FMDV, to identify potential low carbon and resilient infrastructure projects. Through the 100 Climate Solutions Project Campaign, an ongoing initiative supported by the Leonardo DiCaprio Foundation, R20 has already selected over 450 green infrastructure projects around the world.

Projects Structuring: R20, together with foundations and academic institutions, conducts workshops, training programs and policy advisory services to facilitate project designing and structuring. Thanks to a strategic partnership with the Sustainable Infrastructure Foundation (SIF), R20 provides Source trainings. Source is an online software that helps public sector users structure their projects according to development bank standards. R20 has also developed, in partnership with Ecole Nationale Supérieure des Mines in Saint-Etienne (France) and the National Polytechnic School of Oran (Algeria), a specialized Master’s program dedicated to train political decision-makers on policies, technologies and financial models in the field of renewable energy, energy efficiency, waste management and mobility.

Projects Bankability: R20 works with its corporate partners to establish Pre-Investment Facilities (PIFs) to help project developers perform feasibility studies and ensure bankability of infrastructure projects. The first facility, called the Waste Project Facilitator, was launched with EGIS in 2017, and is already supporting the feasibility studies of projects in Africa. A second facility, called the Energy Project Facilitator and developed in partnership with BG and Alpiq, is soon to be operational.

Projects Financing: R20 works with Foundations and Fund managers to provide and attract investment capital to fund project implementation. BlueOrchard, an Impact fund manager, and R20 are developing a dedicated $350 million fund, The Africa Sub-national Climate Fund (SnCF), which uses a “blended financing” model. Plans to replicate this fund for other regions are already in motion. R20 is also working with the Leonardo DiCaprio Planet Pledge Fund, a $1 billion Fund stemming from a coalition of philanthropists.

Projects MRV: R20 works with a leading MRV standard and implementer, namely Gold Standard and Myclimate, to Measure, Report and Verify projects contributions to GHG emission reductions as well as their positive impacts towards the SDGs.

Acting as a liaison manager and connecting the dots between policy-makers, technology providers and public-private investors throughout the entire value chain, R20 harnesses the best expertise that is available to deliver explicit results, fast. In so doing, R20 aims not only to serve its members, but also cities and regions member of major sub-national government networks and associations, namely ORU-Fogar, AER, C40, FMDV and ICLEI.