Green economics: Recognising risk, maximising return

Christophe Nuttall

Executive Director of R20 Regions of Climate Action.

In the years since the 2015 Paris Agreement, conflicting realities have come sharply into focus. Greening the world’s developing economies is an investment opportunity that runs to tens of trillions of dollars. And the investment gap for sub national (regions and cities) low carbon and climate resilient infrastructure also runs to trillions of dollars.

The Paris Agreement, which had countries vowing to keep global warming “well below” 2 degrees Celsius relative to pre-industrial levels, and ideally to no more than 1.5 degrees, marked international political recognition of the urgent threat posed by climate change. But continuing political progress is yoked to sustainable economic transition. Public development finance alone will not be sufficient to achieve the Agreement’s objectives or the United Nations’ Sustainable Development Goals. Impact investing can. In fact, it is already doing so. R20 has found it works in Wilaya of Oran, Algeria (zero waste management), and Mato Grosso State, Brazil (LED street lighting). By year-end, a third impact investment project in Kita Province, Mali will be operational. Across the developing world, capital is being put to work on mid-sized projects 50 MW solar PV with 80 M$US blended finance investment) likely to have high social, economic and environmental impact as well as provide a high return on investment. What’s more, they are tenderly administered by sub national governments, which the UNDP recognised in 2009 as having a key leading role in combating climate change.

This makes economic and environmental sense. Roughly half of the world’s population lives in cities; by 2050, that proportion is forecast to rise to 70 per cent. Urban areas consume two-thirds of the world’s energy. Sub-national authorities have local responsibilities and local power. It falls to them, the UNDP said, to implement 70 per cent of the solutions that can mitigate climate change and 90 per cent of those that enable adaptation to the effects of climate change. Decisions about public transport, waste management, energy-efficient street lighting, small scale renewable energy grid or not grid connected, and other sustainable infrastructure are mostly taken at sub national level. And it is locally that the social and environmental impacts of policies and programmes are first felt and where lies the greatest opportunity to create employment, stimulate the economy, and from the investor point of view, to manage risk. Small but impactful investments that produce good returns in every way – socially, environmentally and monetarily – are waste management, solar projects and LED street lighting.

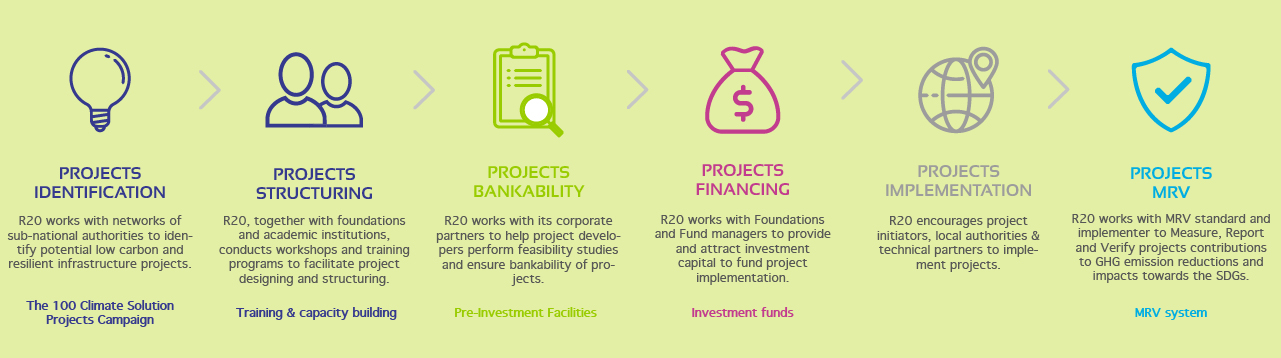

Accordingly, both in 2015 and at the 2017 One Planet Summit organized by French President Emmanuel Macron, the bottom-up sub-national approach was strongly affirmed as essential to achieving the goals of the Paris Agreement. This is where R20 presented its new value chain: i.) Allowing sub nationals to identify their green infrastructure projects, ii.) Enabling technical assistance to get the project to bankability in order to be attractive for public and private investors and iii.) Structuring with impact fund managers blended finance vehicles permitting public investors to derisk the project and therefore secure private investors.

Clearly, what’s next in impact investing and climate cognizant tech is initiatives that parallel the aims and approach of R20 Global Green Fund. The first initiative of its kind in the world, R20 Global Green Fund blends funding from philanthropists, governments, development finance institutions, development banks and private investors for 15 mid-size projects across 10 countries, in India, Africa and latin America.

To bridge this funding gap that most of local and regional authorities are facing world wide as international financing institutions are not equipped to work at sub national level the R20 Global Green Fund blends finance from philanthropists, foundations, governments, development finance institutions, development banks and private investors, deploying a unique ecosystem that fast-tracks the identification, development and delivery of a portfolio of bankable projects. R20 Green Global Fund will invest in up to 15 projects, combining US$ 5 million of donor grant funded technical assistance (to fund project feasibility studies), with US$ 50 million of investment commitments from public governmental sources at junior tranche level (low return investment with first loss risk) permitting US$ 200million from private investors (high return on investment with lowed risks).

R20 Green Global fund is on course for replication elsewhere in the world, not least the network of Latin America capital cities and regions committed to climate change, in the Caribbean, Mediterranean and the 53-member Commonwealth.

The announcement of these sub-national climate funds at the COP 25 UN’s Climate Action summit is the first step down a longer road that leads to the 5B+ Initiative. The target is to mobilize between $ 5 and 8 billion of institutional investment in impactful projects that will power what the UN calls “the race to the top”. It can be won.